Introduction:

Achieving financial stability and building a solid foundation for future success require effective money management strategies. One popular method that has gained recognition is the 50/30/20 finance rule. In this blog post, we will explore this rule in detail, breaking down its components and discussing how it can help you achieve financial balance and make informed decisions about budgeting, saving, and spending.

1. Understanding the 50/30/20 Rule:

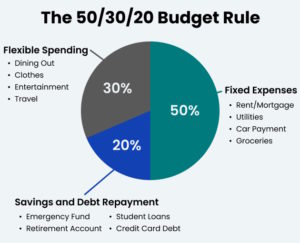

The 50/30/20 rule is a simple yet powerful guideline for allocating your income. It suggests dividing your after-tax income into three categories: 50% for needs, 30% for wants, and 20% for savings and debt repayment. We will delve into each category to help you grasp the essence of the rule and its practical application.

2. Necessities: Covering the Basics (50%):

The first category focuses on essential expenses, including housing, utilities, transportation, groceries, and healthcare. We’ll discuss how to assess and prioritize these needs while finding ways to optimize spending and identify potential areas for cost-cutting.

3. Discretionary Spending: Balancing Wants (30%):

The 30% portion of the rule is dedicated to discretionary spending or “wants.” This category encompasses non-essential expenses such as dining out, entertainment, vacations, and hobbies. We’ll provide tips on managing discretionary spending, making informed choices, and finding a balance between enjoying life and staying within budget.

4. Building Wealth: Savings and Debt Repayment (20%):

The final component of the 50/30/20 rule emphasizes the importance of saving and debt repayment. We’ll explore various savings strategies, including emergency funds, retirement accounts, and other investment options. Additionally, we’ll discuss the significance of paying down debt, such as credit card balances and loans, to reduce interest costs and improve overall financial well-being.

5. Tailoring the Rule to Your Situation:

While the 50/30/20 rule offers a helpful framework, personal circumstances may require adjustments. We’ll guide you in customizing the rule to align with your financial goals, income level, and individual priorities. By tailoring the percentages to fit your needs, you can create a more personalized and effective financial plan.

6. Tracking Progress and Making Adjustments:

Regularly reviewing and adjusting your budget is crucial for long-term success. We’ll discuss the importance of tracking your expenses, evaluating your financial progress, and making necessary modifications. By staying proactive and adaptable, you can refine your financial habits and improve your overall financial well-being.

7. Beyond the Rule: Additional Considerations:

While the 50/30/20 rule provides a solid foundation, there are additional factors to consider. We’ll touch on topics such as managing variable income, tackling debt strategically, and exploring opportunities for increasing income. By going beyond the rule, you can enhance your financial strategies and unlock further growth potential.

Conclusion:

The 50/30/20 finance rule serves as a valuable guide to achieving financial balance and making informed decisions about budgeting, spending, and saving. By allocating your income effectively, prioritizing your needs, and finding a healthy balance between wants and savings, you can establish a solid financial foundation and work towards your long-term goals. Remember, financial success comes from mindful decision-making, ongoing evaluation, and adapting strategies as your circumstances change. Use the calculator below to see your numbers.